Why give the IRS more than you owe?

Keep thousands in your pocket

with our proven, legal tax-saving strategies.

Schedule your free 30-minute Tax Discovery Call

In which we'll review your tax situation and identify specific savings opportunities.

— "With Zero Sales Pressure."

Why give the IRS more than you owe?

Keep thousands in your pocket with our proven, legal tax-saving strategies.

Book a free 30-minute

Discovery Session!!

- "No Obligation Zero Sales Pressure."

30-Day Money-Back Guarantee • No Long-Term Contracts

missing out on Advance tax write offs?

missing out on

Advance tax write offs?

We Reduce your Tax Bill by using the Legal Tax Code...

Reduce your Tax Bill by using

the Legal Tax Code...

📌 Below are 4 out of many comprehensive strategies we use to leverage

existing IRS Internal Revenue Code (IRC)

📌 Below are some comprehensive strategies we use to leverage existing

IRS Internal Revenue Code (IRC)

We understand the full power of the tax code and the legal opportunities within proactive tax credits and strategies that can be implemented before your next filing.

Section 179: For immediate advance expensing.

Section 162: For advance business expenses.

Section 280A(g): Allows homeowners to rent their property without reporting income.

Sections 1361 & 1379: S Corp expense deduction.

The J & P Advantage

Immediate Tax Relief & Year Round Tax Planning

The Advantage

Immediate Tax Relief & Year Round Tax Planning

Pay Less in Taxes — Legally, Morally, and Ethically

Pay Less Tax Legally, Morally & Ethically

Advanced Tax Write-Offs Like

Augusta Rule

Accelerated Depreciation

Equipment Leasing

S- Corp Election

Year Round Tax Planning

Personalized Tax Saving Implementation

Real-time decision

Quarterly strategy

One-on-One Deep dive into your taxes

We also provide Audit protection.

The Advantage

Immediate Tax Relief &

Year Round Tax Planning

Pay Less Tax Legally, Morally & Ethically

Pay Less Tax Legally, Morally & Ethically

Advanced Tax Write-Offs Like

Augusta Rule

Accelerated Depreciation

Equipment Leasing

S- Corp Election

Year Round Tax Planning

Personalized Tax Saving Implementation

Real-time decision

Quarterly strategy

One-on-One Deep dive into your taxes

We also provide Audit protection.

— We provide comprehensive tax advisory and financial planning services

designed to help

individuals and businesses

minimize tax liabilities and maximize tax savings.

📌 Legally reduce your tax burden

by 42% or more

📌 Legally reduce your

tax burden by 42% or more

— We provide comprehensive tax advisory and financial planning services

A personalized tax strategies

based on your situation and industry

📄 Our # 1 Secret Weapon

📄 Our # 1 Secret Advantage

Tax Saving Assessment

designed to help individuals and businesses

reduce tax liabilities and maximize savings.

Tax compliance means putting the right numbers in the right boxes. While this essential

work ensures accuracy, tax optimization is what actually helps you pay less.

designed to help minimize tax liabilities and maximize tax savings.

Tax Assessment Example 2024'

Don't settle for a higher tax bill when strategic planning could reduce it.

Don't let your CPA dictate

your next Tax Bill.

We help business owners build lasting wealth through strategic tax planning, succession preparation, and retirement optimization. Our integrated approach combines proactive tax strategies, business growth expertise, and exit planning to help you maximize value at every stage – whether you’re scaling up, maintaining wealth, or planning your exit. With our "Tax Assessment," you will discover thousands of dollars in potential tax savings year after year.

📄 Our # 1 Secret Advantage

📄 With Our # 1 Secret Advantage

Tax Saving Assessment

designed to help individuals and businesses

minimize tax liabilities and maximize tax savings.

designed to help minimize tax liabilities and maximize tax savings.

Tax Assessment Example 2024'

Don't let your CPA dictate your next Tax Bill.

Don't settle for a higher tax bill when strategic planning could reduce it.

With our tax assessment we find proactive strategies that ensure compliance

with federal and state tax laws while aligning with each client’s

unique tax bill.

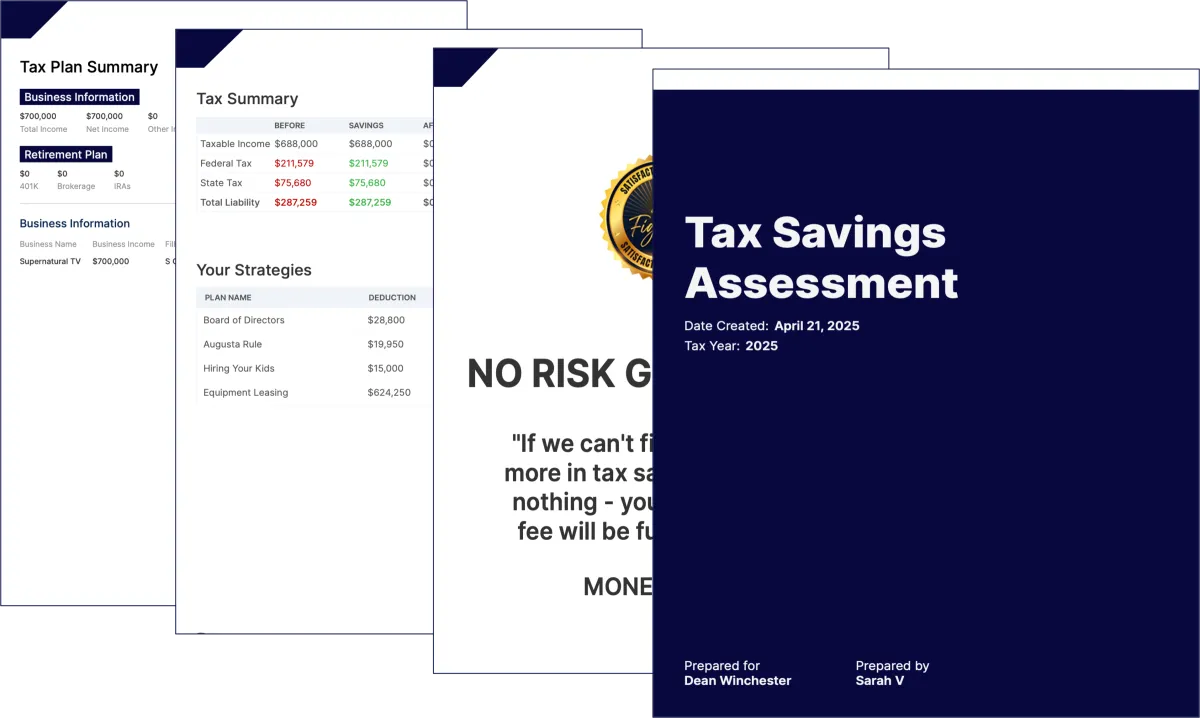

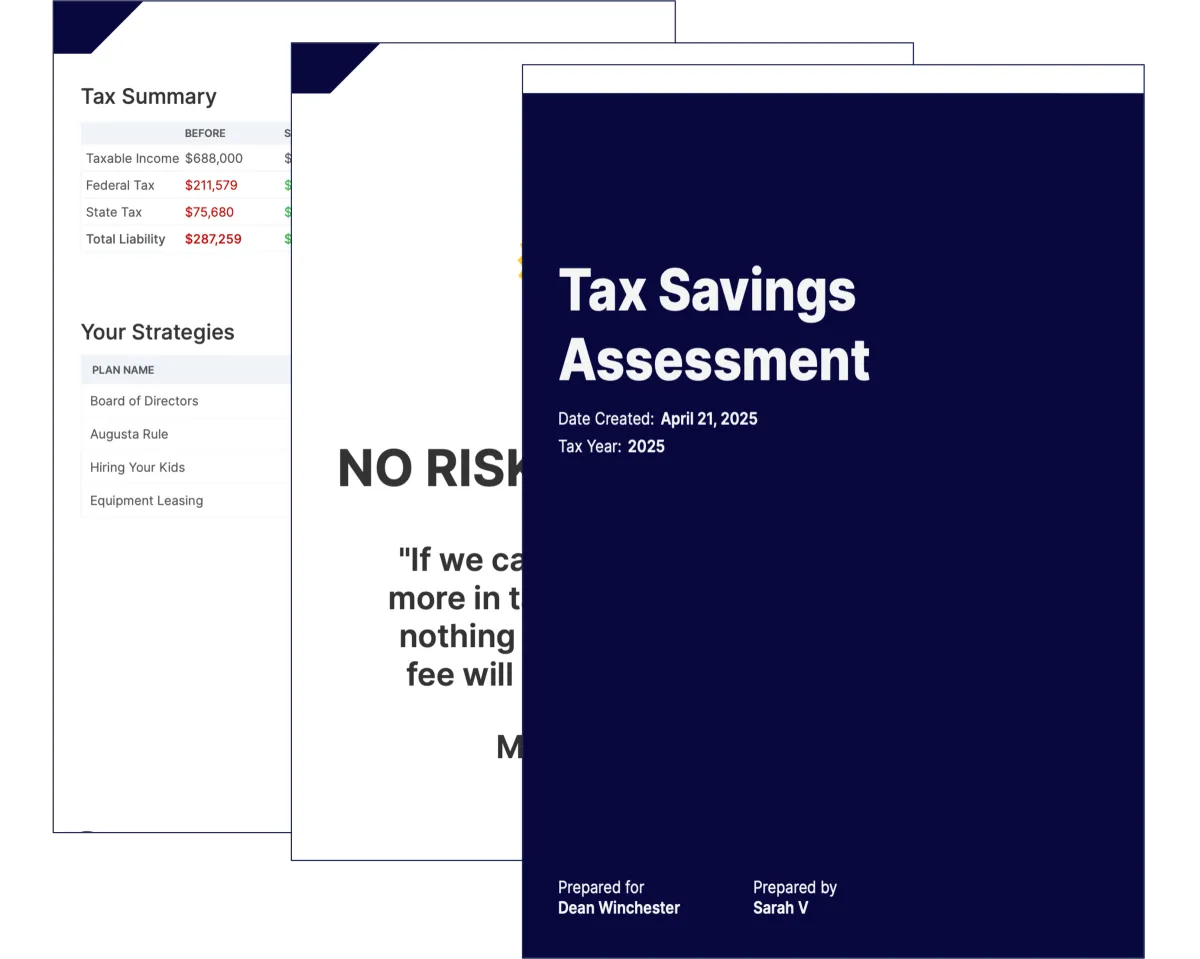

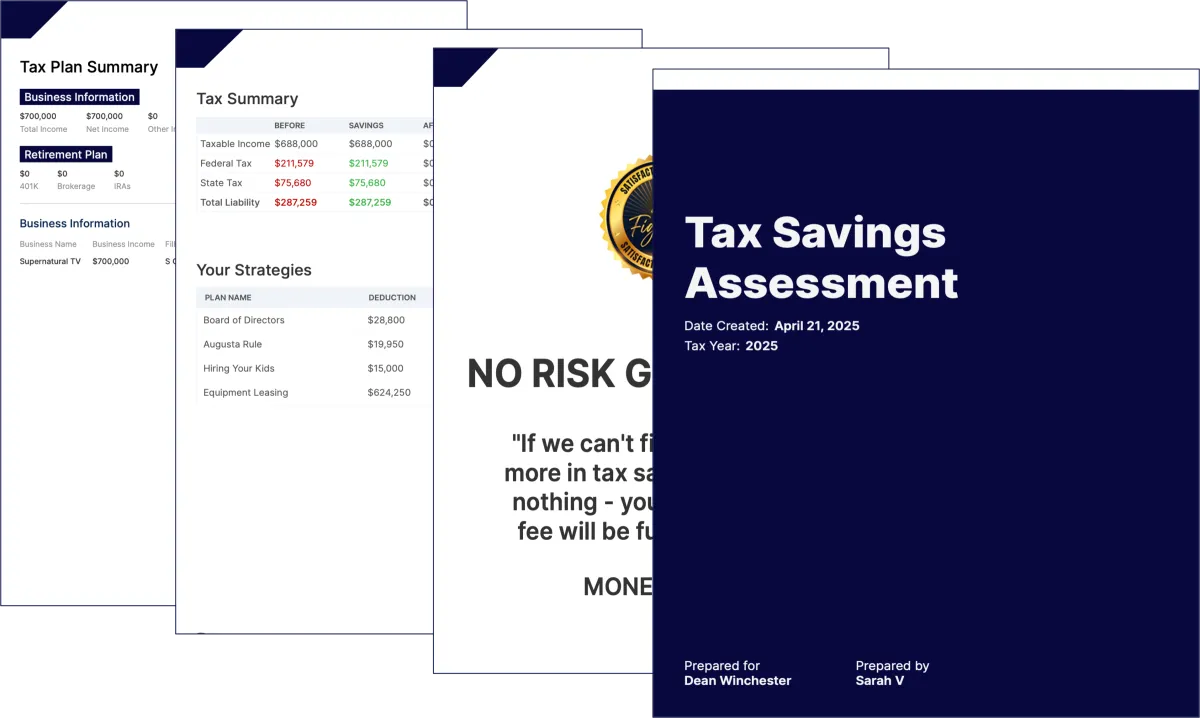

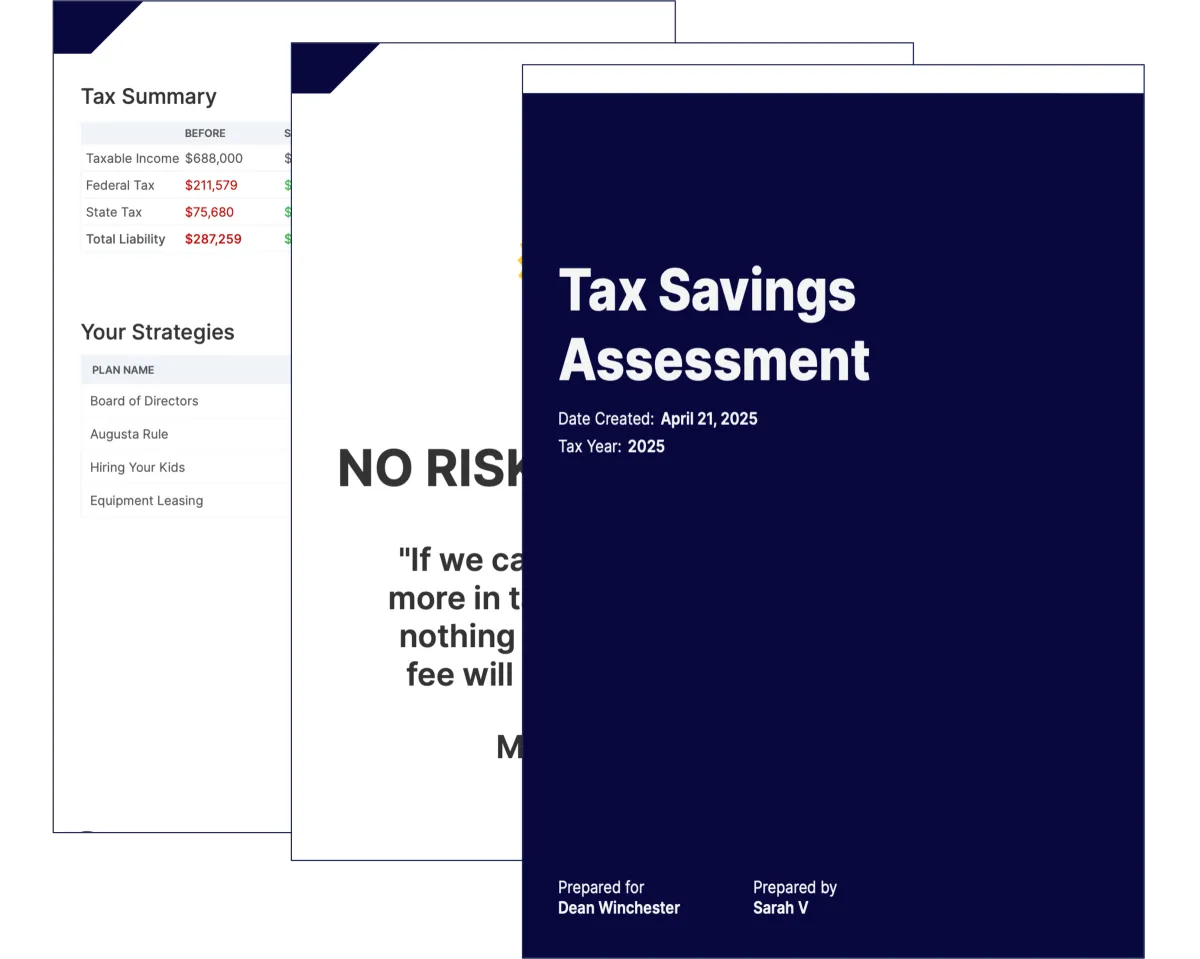

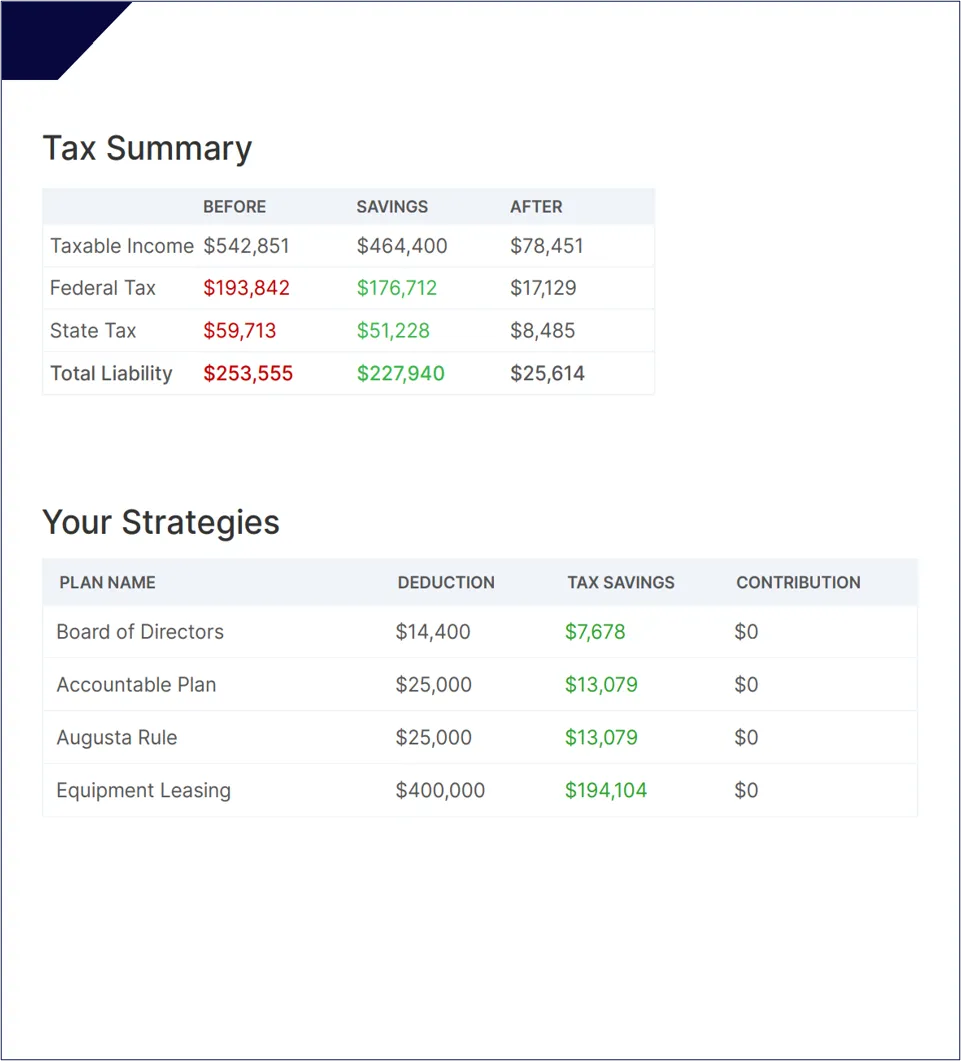

📄 Case Study

Business Tax Assessment

📌 Tax Summary:

Tax Summary:

Clients Tax Liability: $253,555

Tax Saving: $227,940

Homeowner

S-Corp

4 Strategies

📌 The section called "Tax Summary" is a detailed page in our tax assessment that shows

the before and after tax liability. It also shows the personalized strategies used in your case

and how much each one saves.

The section called "Tax Summary" is a detailed page in our tax assessment that shows the before and after tax liability.

It also shows the personalized strategies used in your case and how much each one saves.

We are Proactive in Building your Tax Savings

📌 Beyond basic compliance, we take a proactive approach to tax planning.

Our "Tax Assessment" will outline strategies that save you thousands of dollars year after year.

We are Proactive in building

your tax savings

🛡️

Your Trusted Tax & Investment Specialist

Your Trusted

Tax & Investment Specialist

We'll review your tax situation

and identify specific

personalized saving opportunities

We'll review your tax situation and identify specific

personalized tax saving opportunities.

Chief Tax Planner &

Financial Strategist

Pablo González Pérez

Juris Doctor. CLTC®

Focuses exclusively on

high net-tax-burden.

Senior Tax Advisor & Strategist

Yo

Yo

Yo

Yo

Senior Tax Advisor &

Wealth Specialist

Joshua P. Vallejos

Licensed Financial advisor®

Specializes in advanced

tax saving strategies.

Senior Tax Advisor & Strategist

Chief Tax Planner &

Financial Strategist

Pablo González Pérez

Juris Doctor. CLTC®

Focuses exclusively on

high net-tax-burden

Pablo focuses exclusively on

high-tax-burden

Yo

Advanced Tax Savings

Yo

Business Valuation Expert

Yo

Year-Round Strategic Planning

Yo

Yo

Tax Advisor & Wealth Specialist

Senior Tax Advisor &

Wealth Specialist

Joshua P. Vallejos

Licensed Financial advisor

Joshua specializes in advanced tax strategies most CPAs overlook,

Specializes in advanced

tax saving strategies.

Advanced Tax Strategy

Estate & Legacy Tax Planning

Legal Income Shifting Strategies

Ready to uncover the

write-offs you're missing?

Please Fill Out the

Form Below and Start Saving

Schedule Your FREE

Zoom Call

A 30-minute call to identify exactly

how much you can save in taxes.

We provide comprehensive tax advisory and financial planning services designed to help individuals, families, and businesses minimize tax liabilities, maximize savings, and build long-term financial security.

We specialize in proactive strategies that ensure compliance with federal and state tax laws while aligning with each client’s unique financial goals.

By combining expertise, integrity, and forward-looking solutions, Horizon Tax Planning empowers clients to gain clarity, confidence, and control over their financial future.

Pages

© 2025 J & P Wealth Advisory Group - All Rights Reserved.